Lamina1 Governance and Tokenomics

AMA with Peter Vessenes 2024-04-19

Notes by @EdKeyes (sponsored by Atto¢ash)

DISCLAIMER: I’m not a Lamina1 team member, and this writeup is based on quickly-recorded notes during Peter’s AMA, so treat this information with a certain degree of caution. The official whitepaper should drop within the next week, so that should clarify everything.

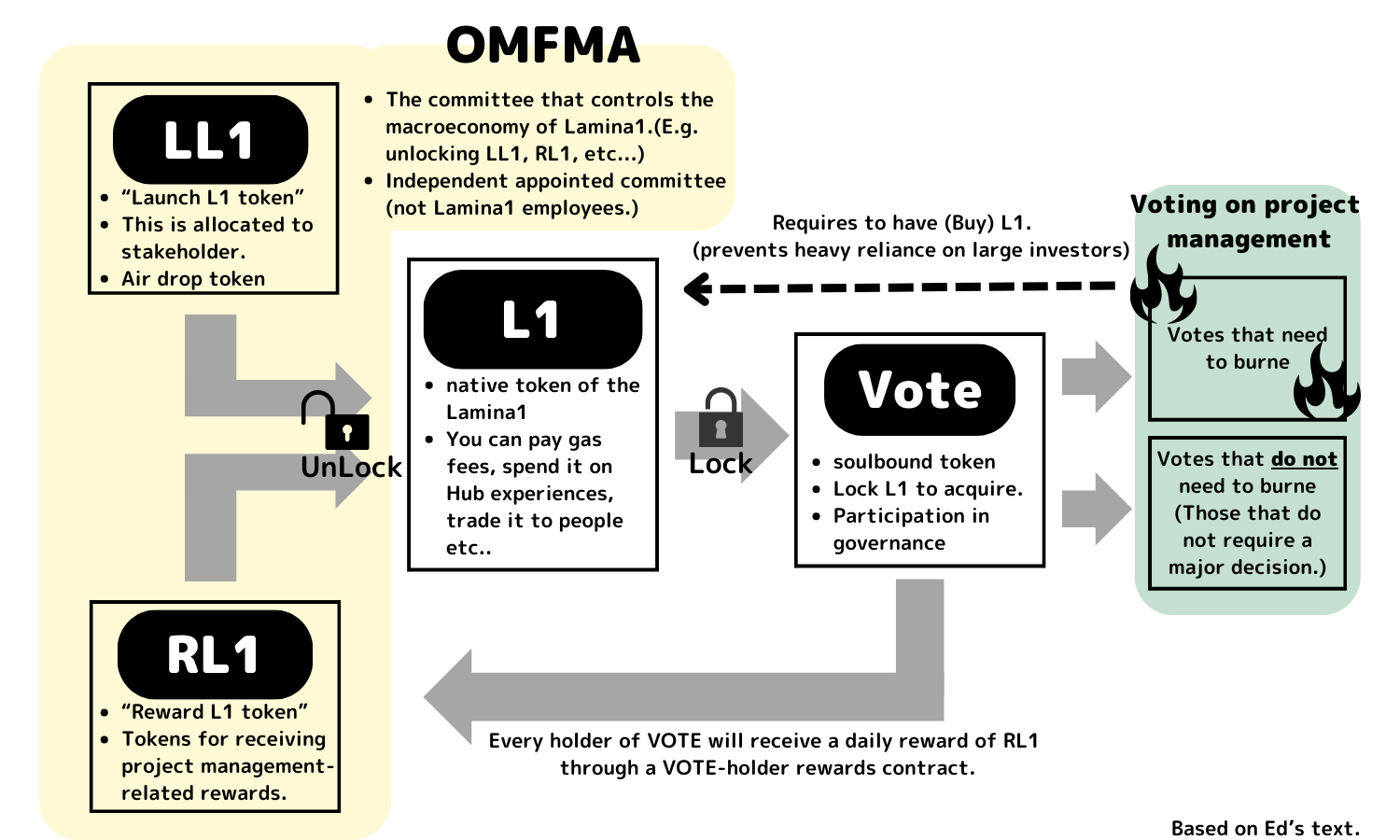

The Lamina1 mainnet will mint a total of 1 billion tokens, most of which will be locked at creation. There are several different types to know about:

This is the unrestricted, native token of the Lamina1 subnet on Avalanche, similar to the betanet L1 token. You can pay gas fees with it, spend it on Hub experiences, trade it to people, exchange it for other currencies, or bridge it to other blockchains. However, very little of it will initially be in circulation, versus the two wrapped forms below.

This is “Launch L1” (formerly “Locked L1”), an ERC20 token which is allocated at mainnet launch to specific holders such as company insiders and the Open Metaverse Foundation itself. The airdrop to community members (see below) will also be in LL1. These tokens aren’t intended to be directly traded, but have a gradual unlock schedule that controls when portions of your holdings can be unwrapped into liquid L1.

This is “Rewards L1”, an ERC20 token which is issued by a continuous reward mechanism to support staking, node-running, and other projects deserving of having a regular income stream, like the Ecosystem Fund. Like LL1, it’s not intended to be directly traded, but can be unwrapped to liquid L1 when received and later unlocked on its own schedule.

This is a separate ERC20 token used for staking and governance. It is soulbound, so is not directly transferable at all. You can mint it by locking up L1 for a period of time; you can burn it to cast a vote; and holders earn daily staking rewards of RL1. See the section below for more details.

The team has seen some failure modes in other crypto launches, where initial large token allocations go to people with incentives to immediately sell them off. That can tank the value of the token right at launch, and sometimes the whole economy never really recovers. Similarly, large unlocking cliffs on specific dates can be problematic, as it leads to speculation and instability.

So the Lamina1 team is erring on the side of locking up tokens and releasing them gradually, to let the amount in circulation grow in sync with the growth of the overall economy and provide some opportunity for stability and price discovery. This will probably be more extreme than more mature crypto projects, with a large proportion of the total value locked for up to 10 years.

They don’t necessarily see volatility in a token as bad, versus wanting to design everything around stablecoins, but mostly want to prevent downside crashes, as upside volatility is less of a concern and easier to deal with.

Of the 500M of LL1 tokens, 32.5M will be allocated at mainnet launch for an airdrop to Discord community members, with an unlock schedule starting right at the grant in order to get some L1 into circulation.

The details are still to be announced, but this should be broadly similar to the betanet airdrops, in that it intends to reward helpful community participation, Zealy quests, use of the betanet, and a certain minimum level of grant for everyone. It will be managed through the Hub rather than by a Discord bot, though.

The airdrop is likely going to be the primary source of tradeable L1 tokens in the early days of mainnet, as the Foundation does not intend to directly sell tokens on exchanges themselves. So the community is going to be the ones setting the prices as they trade with each other and with anyone outside of the community who wants to purchase L1.

There are three important levers controlling the Lamina1 macro-economy:

To determine these rates, there will be an Open Metaverse Foundation Monetary Authority (OMFMA), an independent appointed committee, i.e. not Lamina1 employees, who will meet on a quarterly basis, starting three months after launch.

This is sort of similar to the Fed, with a mandate to maintain a stable economy, control inflation, protect people from the effects of speculation, and so forth. The general goal is to match the growth of the L1 token supply to the organic growth of the L1 economy, rather than getting into a hyperinflation scenario of issuing excess tokens that nobody is demanding.

To start with, it’s expected that RL1 will unlock faster than LL1, but this may be adjusted over time.

The OMFMA controls the overall issuance of RL1, but there is a Rewards Contract that determines how that funding flow is allocated to specific uses. This is a more flexible, programmable replacement for things like proof-of-stake delegation.

You can imagine this contract as a list of possible funding categories and projects, each with a point score:

Reward recipient | Score |

VOTE-holders (staking) | 500 |

Node operators | 300 |

Ecosystem Fund | 200 |

----- Threshold —-- | —-- |

Persona Collective | 50 |

Atto¢ash | 3 |

Every day, some RL1 will be issued to those categories above a certain threshold, proportionally to their score out of the total. If 100 RL1 was the daily reward, then VOTE-holding stakers would collectively get 50 RL1, node-runners would get 30 RL1, etc. The community will decide these scores by a voting mechanism, described below.

Under the hood, each project will have its own smart contract to receive RL1 from the Rewards Contract and allocate it to the relevant destinations, such as the individual node operators, according to its own rules.

The VOTE token is a unified treatment for staking and governance, replacing things like validator delegation.

To obtain VOTE tokens, you have to lock up liquid L1 into a smart contract for a period of time. You can mint 1 VOTE for every 1 L1 you lock up for 1 day, up to a maximum of 10 years. So if you locked up 100 L1 for 1 year, you would mint 100 * 365 = 36500 VOTE tokens. And you would get your original 100 L1 back after the year, too.

VOTE tokens are soulbound when minted, so they cannot be traded. Every holder of VOTE will receive a daily reward of RL1 through a VOTE-holder rewards contract, proportional to their fraction of the total number of VOTE tokens outstanding. Recall that the RL1 you receive will typically have its own unlock schedule too, rather than being immediately convertible into L1.

To earn staking rewards, there is an incentive to lock up L1 for longer periods of time, because you’re competing with other stakers for slices of a finite rewards pie. If you and a friend each have 1 L1, but you commit to stake for 1 year while he stakes for 1 month, you will have 365 VOTE to his 30 VOTE, and will receive 12 times as many RL1 as he does.

Over time, this can somewhat even out, as he would get his 1 L1 back in a month and be able to mint another 30 VOTE, while your 1 L1 remains locked up. If this continued, he would end the year with the same 365 VOTE, but since you have been holding yours for longer, you’ll have earned about twice as much RL1 as he did: your extra reward for committing to a longer lock-up period. (And you can roll that reward back into more staking that much sooner, too, to keep the virtuous earning cycle going.)

VOTE tokens can be burned to change the score of projects in the Rewards Contract, basically upvoting or downvoting projects according to the priorities of the community. Since burning tokens sacrifices your staking rewards, it’s probably not something to do lightly, but if you feel strongly about a project or have an economic incentive to support it (such as if you’re a node-runner and want more rewards to be allocated for node owners), then it can be worthwhile.

This can work similarly to community proposals in other blockchain projects, but you have to “put your money where your mouth is” to support a proposal instead of whales just casually throwing their holdings around and dominating project-wide decisions at zero cost to them.

It is also anticipated that there will be some decision-making processes that don’t require burning tokens, as they would be more like community polls instead of financially-important policy choices. This would happen more like a temporary delegation of tokens by VOTE holders.

Courtesy of @Ikkaku-man:

I hope this summary has been useful. Peter said he’s handing the final governance and tokenomics whitepaper to Ivy “today”, so it ought to be published next week and contain a lot more detail and clarity.